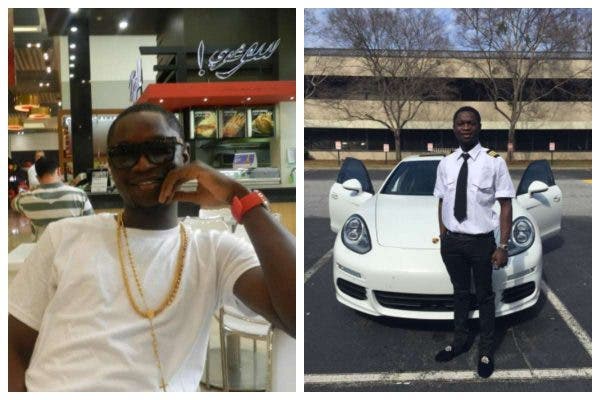

A Nigerian man named Bamidele Muraina has been sentenced to 70 months in prison over $2.6m fraud in the U.S.

35-year-old Bamidele, better known as Dele Ewe, was also ordered by a U.S. court to pay $561,125.62 in restitution.

His conspirator, Gabriel Kalembo, 33, of Zambian, was sentenced to 50 months in prison and ordered to pay $298,008.71 in restitution.

A statement released by the U.S Justice Department said, “Bamidele Muraina, a Nigerian national who hacked into tax preparation firms and filed fraudulent unemployment benefit claims and tax returns using stolen personally identifiable information, and Gabriel Kalembo, a previously convicted fraudster who laundered the fraudulent assets, have been sentenced to federal prison.”

Acting U.S. Attorney Kurt R. Erskine said: “These defendants stole funds from programs meant to assist American workers and families seeking to make ends meet during the COVID-19 pandemic.

“The collaborative efforts of our law enforcement partners were essential to disrupting a sophisticated network of criminals and bringing their leaders to justice.”

Bamidele Muraina engaged in a conspiracy to defraud the Employment Security Department of Washington State (“ESD-WA”) by filing dozens of fraudulent unemployment insurance (UI) claims in the names of identity theft victims who were not entitled to such benefits.

As part of the same conspiracy, Gabriel Kalembo and his conspirators laundered the unlawfully obtained UI benefits from ESD-WA by purchasing and then later negotiating hundreds of money orders.

According to Acting U.S. Attorney Erskine, Bamidele Muraina was a Nigerian national residing in the metro Atlanta area at the time of his offenses.

Between at least January 29, 2018, and continuing through approximately April 2020, Muraina hacked into multiple tax preparation and accounting firms located in several states, including a Brunswick, Georgia-based accounting firm.

Muraina obtained access to the firms’ accounts with a national tax preparation program, stole personally identifiable information from their clients, and filed more than 275 fraudulent individual income tax returns in their names via the Internet.

In total, Muraina’s fraudulent tax returns using stolen identities sought refunds from the IRS exceeding $2.6 million from 2018 through 2020.

Between May 9, 2020, and May 16, 2020, Muraina used stolen personally identifiable information from Washington residents to submit false claims for unemployment insurance benefits in Washington.

Muraina’s false claims exploited a federal COVID-19 pandemic relief program created by the Coronavirus Aid, Relief, and Economic Security (CARES) Act, which expanded eligibility for unemployment benefits and provided an additional unemployment benefit of $600 per week.

Based on Muraina’s fraudulent claims submitted in the names of approximately fifty Washington residents over a one-week span, the State of Washington issued more than $280,000 in unemployment benefits.

Muraina directed fraudulent funds from his unemployment benefits scheme and tax fraud scheme to be deposited into bank accounts set up by co-conspirators, including Gabriel Kalembo, who was convicted in 2017 of conspiracy to commit wire and bank fraud in the Northern District of Georgia.

Kalembo recruited Zambian nationals to travel to the United States on tourist visas to incorporate sham corporations in Georgia and open business bank accounts in the names of those corporations.

After the fraudulent funds were deposited into those accounts, Kalembo laundered the funds by cashing money orders purchased with debit cards linked to the accounts.

Bamidele Muraina, 35, of Oyo, Nigeria was sentenced by U.S. District Judge William M. Ray II to five years and ten months in prison to be followed by three years of supervised release, and he ordered Muraina to pay $561,125.62 in restitution.

Gabriel Kalembo, 33, of Atlanta, Georgia was sentenced by Judge Ray to four years and two months in prison to be followed by two years of supervised release, and he ordered Kalembo to pay $298,008.71 in restitution.

The case was investigated by the U.S. Secret Service, the Department of Labor Office of Inspector General, the Internal Revenue Service Criminal Investigation, the Department of Homeland Security-Homeland Security Investigations, and the United States Postal Inspection Service.

Assistant U.S. Attorneys Nathan P. Kitchens, Chief of the Public Integrity and Special Matters Section, Sarah E. Klapman, and Lauren T. Macon are prosecuting the case.